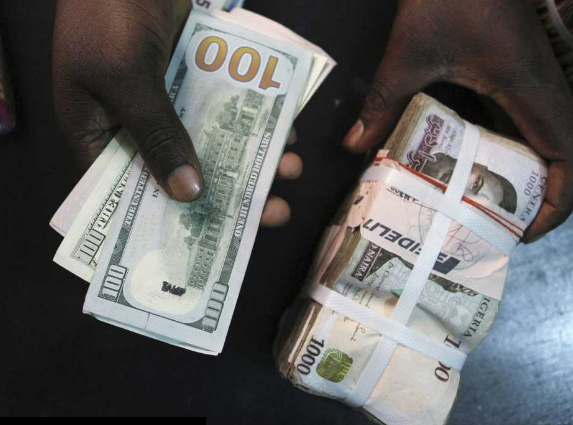

The Association of Bureaux de Change Operators of Nigeria (ABCON) has thrown its weight behind the Central Bank of Nigeria’s directive, endorsing the cessation of domiciliary accounts as collateral for naira loans. President Aminu Gwadabe conveyed the association’s support, emphasizing that this measure would bolster liquidity in the currency market and fortify the nation’s financial reserves.

The directive, as outlined in a circular titled ‘The use of foreign-currency-denominated collaterals for naira loans,’ mandated Nigerian banks to discontinue the practice of utilizing foreign currency deposits as collateral for naira loans. Banks were given a three-month window to phase out such transactions, aligning with the apex bank’s stance on this matter.

Gwadabe highlighted concerns over companies leveraging their non-oil export domiciliary accounts as collateral for naira loans, advocating for a review of the guidelines governing the holding of currencies in these accounts. He proposed a maximum holding period of 48 hours for non-oil export accounts and suggested that applicants with significant balances in their non-oil export proceeds domiciliary accounts should not be eligible for foreign exchange requests through official windows.

Furthermore, Gwadabe called for an overhaul of CBN policies governing BDC operations, advocating for their transformation into legislation to enhance investor confidence. He emphasized ABCON’s commitment to engaging stakeholders in efforts to enhance market efficiency, transparency, and balance of payments in the retail foreign exchange market.

The CBN’s recent sale of $10,000 to eligible BDCs at a rate of N1101/$1 underscores the importance of regulatory measures to maintain market stability. The apex bank reiterated the imperative for BDCs to adhere strictly to regulations, warning against selling at spreads exceeding 1.5 percent above the purchase price to mitigate speculation and ensure price stability.

Related posts:

Enugu Constable Applicants' CBT Set for Tuesday, Wednesday4 months ago

Breaking News

JAMB's approved Exams Centres in Kano for 2024/20254 months ago

Economic

Veteran Actor Amaechi Muonagor, 61, Mourned by Fans4 months ago

Breaking News

First Lady: Tinubu's Vision Sparks Promising Results"4 months ago

Breaking News

Benylin Cough Syrup Recalled by NAFDAC4 months ago

Breaking News